GST was only introduced in April 2015. The introduction of the six percent GST in Malaysia from April 1 2015 will bring forth radical changes to the Malaysian tax landscape.

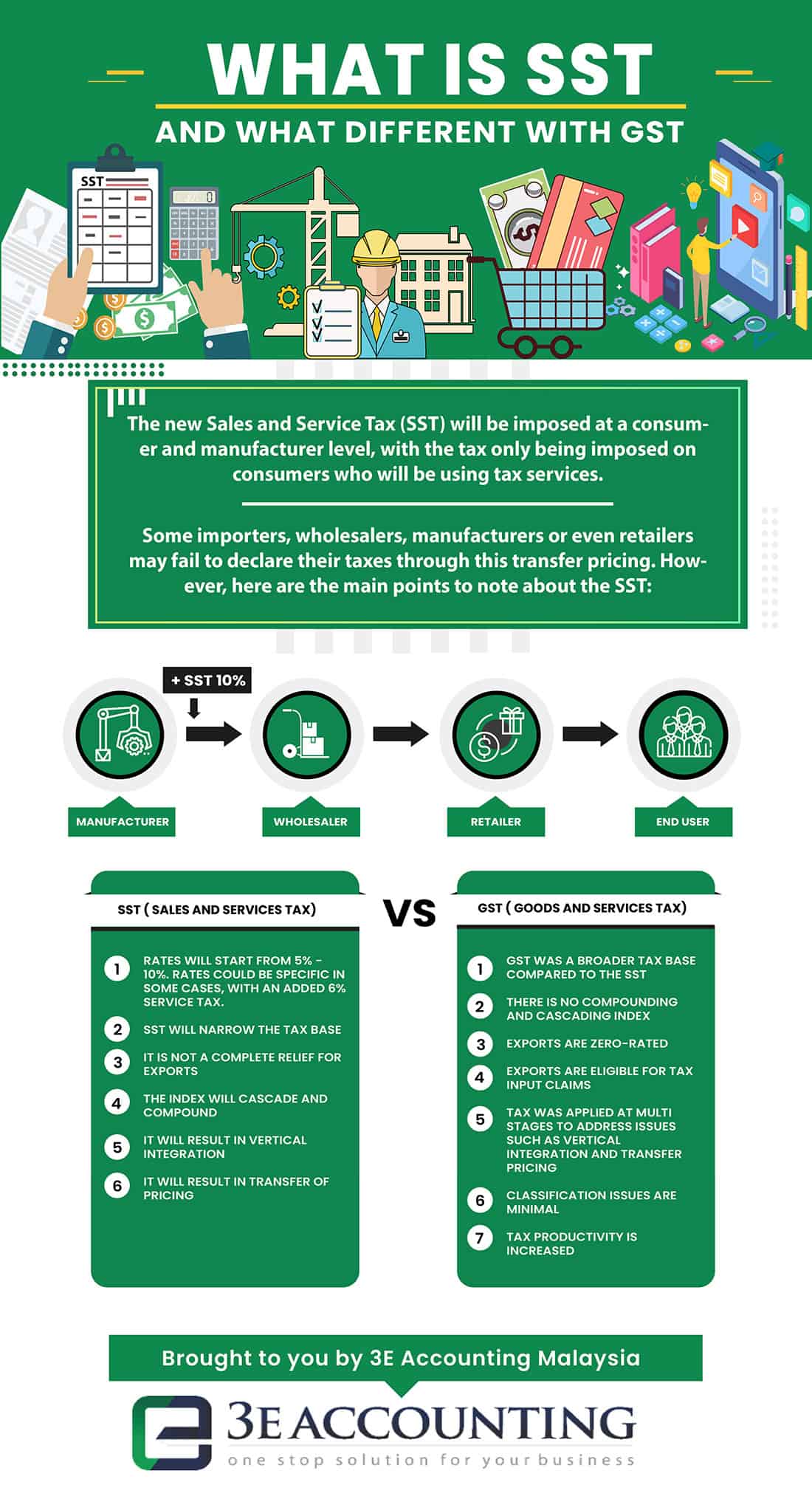

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

During Affin Hwang Capitals Malaysia Economic Outlook and Construction Sector Briefing today Affin Hwang Capital chief economist Alan Tan said that the implementation of the tax would.

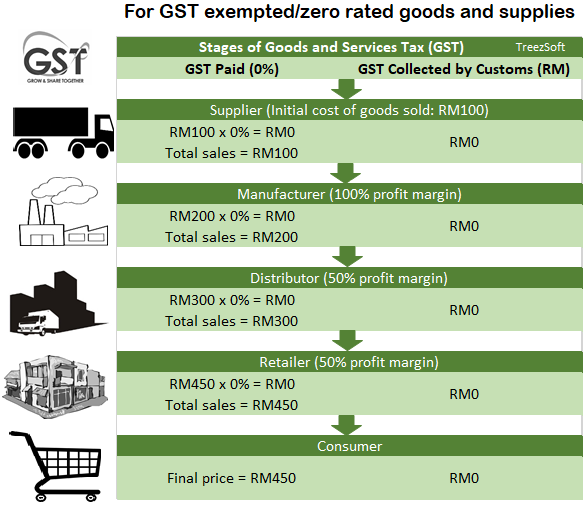

. The current rate imposed on all consumption of taxable goods and services is 6. The first step of the transition began on 1 June 2018 when GST was adjusted from 6 to a 0 rate across Malaysia. For GST Malaysia there are 3 types of supply.

The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6. Amendment to final GST return. Amendment to final GST return due by 31 August 2020.

Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy. Malaysia reintroduced its sales and service tax SST indirect sales tax from 1 September 2018. The existing standard rate for GST effective from 1 April 2015 is 6.

A company supplied goods services before 01 June 2018. Many domestically consumed items such as fresh foods water and electricity are zero-rated while some supplies s. Abolishment of GST in Malaysia.

This guide includes everything you need to know about digital tax laws in Malaysia whether your customers live in Kuala Lumpur or Putrajaya. Malaysias recent addition of a Goods and Service Tax GST which was passed by the government during the third quarter of 2011 but delayed until April 2016 has been the cause of much confusion within ASEANs second most developed economy. Utility companies should make adjustments in subsequent bills.

Lets start with how GST was abolished. Until then a transitional arrangement will be in place to help businesses acclimate to the new environment. The Finance Ministry through the Royal Malaysian Customs Department is committed to ensuring that the Goods and Services Tax GST refund to taxpayers will be.

Malaysia GST Reduced to Zero. Below is a summary of the points for taxpayers to consider during the transition period. Goods and services tax to sales and service tax transition rules.

Overview of Goods and Services Tax GST in Malaysia. KUALA LUMPUR - Malaysias goods and services tax GST will be reduced from 6 per cent to zero per cent on June the Finance Ministry said on Wednesday May 16. In determining this threshold income arising from the supply of capital assets of the business which was previously excluded will now fall within the RM500000 threshold unless the capital assets are supplied or transferred as a result of the cessation of.

Although no firm date has been set Dr Mahathir has stated that SST will be implemented in September 2018. The GST rate previously proposed in the GST bill in 2009 by the Malaysian Government was 6. Roughly 90 percent of the worlds.

It replaced the 6 Goods and Services Tax GST consumption tax which was suspended on 1 June 2018. The Sales Tax is levied at the import or manufacturing levels and companies with a sales value of taxable goods exceeding RM500000 in a 12-month period are liable to be registered for the tax which is levied at rates varying from 5 to 10 depending on the goods in question. At this point in time the rate may be slightly higher.

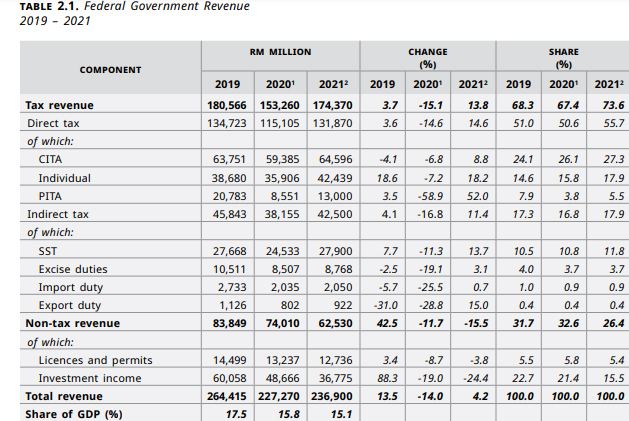

The government is likely to look into the possible reimplementation of the goods and services tax GST but the implementation of the tax would likely be in 2022 and into 2023. Brief history about GST. GST is collected by the businesses.

Standard-rated supplies are goods and services that are charged GST with a standard rate. Amendments to the final GST-03 return if any must be. The GST also known as value added tax VAT in some countries is not a new concept of taxation as other countries in the region introduced GSTVAT years ago.

The previous service tax is no longer applicable to tax invoices issued on and after 01 April. To modernise its taxation system and improve business efficiency Malaysia replaced its Sales and Service Tax regimes with the Goods and Services Tax GST effective 1 April 2015. The Malaysian GST system has two rates of GST 6 and 0 and provides for the zero-rating of exported goods international services basic food items and many.

The SST registration due date is the last day of the month following the month in. The current browser does not support Web pages that contain the IFRAME element. For more information regarding the change and guide please refer to.

However digital services provided but foreigners to consumers in Malaysia exceeding RM 500000 per year will have to register for Service Tax from the start of 1 January 2020. Goods and Services Tax GST was implemented on 1 April 2015 at a standard rate of 6. Thats what this guide is for.

This guide outlines the topics you need to know about sales and service tax SST in Malaysia. For more information regarding the change and guide please refer to. Today more than 160 nations including the European Union and Asian countries such as Sri Lanka Singapore and China practice this form of taxation.

The Goods and Services Tax GST is an abolished value-added tax in Malaysia. On the 1 June 2018 the new Malaysian government withdrew the Goods and Services Tax GST. In some countries it is known as VAT or Value-Added Tax.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Both the Malaysia GST and Singapore GST are broadly. In line with the announcement made by the Malaysian Government Goods and Services Tax GST has been implemented with effect from 01 April 2015.

Malaysia GST Reduced to Zero. Malaysian businesses are required to register for GST when their turnover threshold hits RM500000. It was replaced with a sales and services tax SST on 1 September 2018.

GST should be charged at 6 up to 31 May 2018. Sales Tax 10 On any taxable goods and imported taxable goods in Malaysia a single-stage sales tax is charged by the registered manufacturers. 858 PM MYT.

Malaysias goods and services tax GST was replaced by the sales tax and services tax but there are still transitional GST issues that may need to be resolved. The hope and purpose of GST is to replace the sales and service tax which has been used in the. Exempted from SST registration are tailoring jewellers and opticians.

From 01 June 2018 GST should be charged at standard rate of 0. SST is administered by the Royal Malaysian Customs Department RMCD. On 1 September 2018 SST is re-introduce to replaced GST.

No matter where you live or where your online business is based if you have customers in Malaysia you gotta follow Malaysian GST rules. The concept behind GST was invented by a French tax official in the 1950s. The Ministry of Finance MoF announced that starting from 1 June 2018 the rate of the Goods and Service tax GST will be reduced to 0 from the current 6.

Gst Malaysia Goods And Services Tax Brake Pads Malaysia Cal Logo

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Goods And Services Tax Gst In Malaysia 2015 Goods And Services Goods And Service Tax Malaysia

Hi Accounts Gst Ready Accounting Software Malaysia Make Your Business Easy With Gst Easy To Handle Easy Track Accounting Software Accounting Computer Crash

What Is Gst Goods And Services Tax Or Gst Is A Consumption Tax Based On Value Added Concept Unlike The Present Sales Tax Or Service Tax Which Is A Single Stage Tax Gst Is A Multi Stage Tax Payment Of Tax Is Made In Stages By Intermediaries In The

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Hoping You Ll Love This Post Proton Ertiga Executive Manual Http Nazzjanggut Blogspot Com 2017 08 Blog Post Html Utm Cam Protons Electric Power Economical

No Gst Price Remains Good News All Leagoo Malaysia Absorp Gst Charge For Models Stated Below Lead 2s Rm499 Lead 7 Cal Logo School Logos Logos

Harga Design Corporate Shirts Corporate Uniforms Company Uniform

Casio Adds The All Terrain Gst Bs300 To Its G Steel Lineup Werd Relogio G Shock Acessorios Masculinos G Shock

An Introduction To Malaysian Gst Asean Business News

Hi Cikgu Sila Check Semua Pilihan Cop Ulasan Guru Pelbagai Bahasa Di Http Www Ezstamp Com My Categories Teacher Stamp Teacher Stamps Printer Cop

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Sales And Service Tax Training In Ipoh Hrdf Claimable Vanue Aks Training Centre Ipoh Date 16 08 2018 Time 9 Training Center Ipoh Goods And Services

Gst In Malaysia Will It Return After Being Abolished In 2018

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll